[Hide]

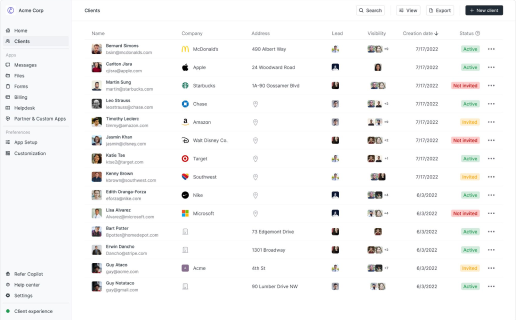

Accountants run on Copilot

Differentiate your accounting business with white-label portal that gives your clients a one-stop shop to access dashboards, submit tickets, send messages, make payments, and more.

4.9 rating

If you're finding that managing client contracts feels overwhelming and unclear, you're not alone. Knowing what to include in a contract, and how to send them, was always something I struggled with when I started my agency.

And you’d be surprised how many firms struggle with ambiguous agreements that lead to miscommunications, delayed payments, and even legal headaches.

That’s why I put together five amazing accounting contract templates to help you protect yourself from legal trouble, streamline your client onboarding process, and give you the confidence to focus on what you do best — actually providing your services.

Alright, no more rambling. Let’s first go over what you should include in your contracts, and then go over some templates.

What to include in an accounting contract

Knowing what to include in an accounting contract template is one of the first steps to running a successful firm. It will help you understand how to read contracts and know what templates make the most sense for your services.

A great accounting contract will include sections that explain what parties are involved, the scope of work, the deliverables, payment terms, confidentiality clauses, and termination policies.

Let’s go over each of these.

Parties involved

Knowing who is working on a project is the first step. In other words, you should list all of the parties to the contract in this section. There will primarily be two parties involved in this:

- You, the provider of accounting services.

- Your client is the individual or company that you provide your services to.

You should also confirm that the person signing the contract has the legal right to do so, depending on whether your intended client is an individual or a company. If you're working with a business, this will be quite important, so be sure the individual signing is the appropriate person representing the company.

This part is simple, but once you start working on a project, it's crucial to be very explicit from the beginning about who this contract pertains to. You want to be very attentive and vigilant about your accounting contracts because you're working with money, which is also referred to as people's livelihoods.

Scope of work

After figuring out who is involved, you need to explain what you will do to help them. The precise accounting services you will offer are outlined in this section of your contract.

To avoid scope creep or any misunderstandings about the kind of work (and how much) you will be doing, you want this section to be as specific as possible.

Professionals provide the following general accounting services:

- Balancing credit card and bank statements

- Financial transaction recording and classification

- Making monthly financial reports (balance sheet, cash flow, or profit and loss)

- Monitoring of accounts payable

- Processing payroll and estimating taxes

- Reporting and submitting sales taxes

Being explicit about the services you will not offer is also a smart idea. I’m aware of this since I personally use different services to file taxes and reconcile bank statements. Customers may expect you to provide these services together at times. Just be clear to save yourself headaches down the road.

Deliverables

The what and when of your services will come next. Although the scope of work covers everything in detail, this section will go more in-depth about the precise deliverables. When those deliverables are expected will also be mentioned in the deadline.

Here's what can be included in this section:

- Weekly deliverables: In this section, you should outline the metrics you plan to monitor using a particular accounting program.

- Deliverables for each month: In this section, you should describe any monthly reports that are produced. You can also be required to file sales tax returns.

- Deliverables on a quarterly basis: These could include financial reports and working with a certified public accountant to prepare taxes.

- Deliverables for the year: This could include tax statement preparation, annual reports, and assistance with tax filing.

You want to be explicit about the precise timeframes for this entire section. The response times must also be mentioned. For example, "X business days upon request" may be used to indicate how quickly your client must reply to any documents that are required.

You should also note that deadlines may be changed with advance notice for national holidays or unanticipated events if you expect any delays or holidays.

Payment terms

Next up is my favorite — getting paid.

This section of your accounting contract makes sure both you and your customer are on the same page regarding how much your services will cost, when payments are due, and what happens if a payment is not paid or is late.

Here’s what you could include in this section:

- Pricing packages: In this section, you will choose whether you bill on an hourly, monthly, or project-by-project basis.

- Billing frequency: In this section, you should specify when your client will be billed. Is it every month on the first, every two weeks, or after a project is finished?

- Initial deposits: Depending on your billing philosophy, you may ask clients for retainers or upfront payments before you begin working on a project for them.

- Payment methods: You should include a list of approved payment methods here. ACH transfers, credit cards, bank transfers, or any other method. Don't forget to include what you desire and what you offer. Pro tip: Copilot's Billing App can help you throughout this entire process.

- Late fees: You can specify whether there are any late fees and what they are if customers don't make their payments on time.

- Refund policy: Indicate here whether you provide refunds. Whether you give full or partial refunds, make sure to specify what you offer and under what conditions.

Make sure you’re clear in this section. You deserve to be paid what you are worth.

Confidentiality

The next topic is security and confidentiality, which are crucial when it comes to money.

Keeping your clients' financial records safe is your duty as an accountant. Payroll records, bank statements, and tax paperwork are among the most private data that you have access to. These should be protected and maintained near you and your customers. To protect yourself and your clients, you should have certain confidentiality clauses.

Here’s what you could include in this section:

- NDA: You can include a clause in your contract that states that all parties will not divulge or share any information that is being transferred during or even after the term of the agreement.

- Industry standards compliance: You can bring up compliance with SOC 2, GDPR, IRS regulations, or other security legislation in your (and your client's) location when working with businesses.

- Safe file and data sharing: Here, you should specify how you plan to safeguard important documents, financial reports, and login credentials. With Copilot, you can rest easy knowing that every document you or your clients upload to the Files App is safe and secure.

- What happens in a breach: In this section, you can describe the steps that will be taken in the event that sensitive data is accessed without authorization or if a data breach occurs.

Ideally, your client grants you access to private data in their accounting software. In this sense, many of the security features of your services are the responsibility of those platforms. As an illustration, many accountants use Copilot for client administration and file storage, and QuickBooks or Xero for bookkeeping.

Please remember that neither Copilot nor I are liable for your actions after reading any of Copilot's blogs. Regarding your contracts, make sure to get advice from a local attorney or legal expert.

Termination policy

Although it's always better to be safe than sorry, maybe you won't have to deal with this aspect of your accounting contract. All parties should understand how to terminate a contract, how much notice is needed, and what happens following termination if your contract has a clear termination clause.

You may occasionally have to deal with clients who are just awful. In other situations, a customer can wish to discontinue your services. In any case, you want to make things simple and painless for everyone. Having this section provides your clients peace of mind and increases their faith in you, even if you don't expect (or want) a termination to happen.

Here’s what you could include in this section:

- A notice period: You should specify how much notice each party must provide before a contract expires. This might occur around 30 days prior to the subsequent billing period.

- The last payment is necessary: If a contract is to be terminated early on your client's behalf, you might state here whether there are any penalties or requirements for the final payment. This is also where you can establish a refund policy.

- Data access or transfer: Here, you should be very clear on how you will transfer data in a professional, safe, and efficient manner.

- Breach of contract: In this case, you should state a legitimate defense for an instant contract termination. For instance, if payments or invoices are never received, if any information is withheld, or if any secret agreements are broken.

Also, if you're working with long-term or annual contracts, be sure to specify any applicable early termination fees.

Now, to make your life easier, let’s go over some accounting contract templates that cover all of these points.

5 accounting contract templates you can use in 2025

Here are five accounting contract templates you can use:

- Nitro accounting contract

- Legal Zoom accounting contract

- SignWell accounting contract

- Signaturely accounting contract

- Rocket Lawyer accounting contract

Alright, let’s take a look at each one.

1. Nitro accounting contract

First up is Nitro’s accounting contract template. The great thing about this template is that it’s easy to use and can be easily downloaded as a free PDF. The template covers core areas in a contract like:

- Identification of parties: Provides the client's and the accounting firm's information in clear terms.

- The scope of services establishes expectations and gives project clarity by outlining the precise services and deliverables.

- Fee schedule and terms of payment: Describes the pricing structure, billing schedule, and due dates.

- Confidentiality clauses: Safeguard private company and financial data.

- Termination and amendment procedures: Outlines the length of the contract, the terms under which it may be terminated, and the procedures for any upcoming changes.

By using Nitro’s template, modern accounting firms can have confidence in their legal compliance, preserve professionalism, and save time with a pre-made template. It’s also adaptable for different services and can be edited — making it a great starting point for your accounting contract.

2. Legal Zoom accounting contract

Next up is Legal Zoom's accounting contract. If you're in the online business space, there's a good chance you've heard about Legal Zoom. In fact, I've used their services myself.

Their accounting contract template offers a well-rounded, legally vetted framework designed to clearly define the relationship between your accounting firm and your client. This template covers all the essential sections like:

- Detailed service descriptions that make sure everyone is aware of what is expected from the services that are offered.

- Clear fee structures that help to avoid future misunderstandings by outlining payment terms, billing cycles, and any applicable penalties.

- Data protection and confidentiality contain clauses that protect private financial data, which is crucial in the field of accounting.

- Procedures for dispute resolution to offer precise instructions on how to resolve issues, guaranteeing that they are handled effectively.

- Termination and amendment clauses provide flexibility as business needs change by outlining the terms for terminating or changing the contract.

By establishing clear expectations right away, this template not only gives your clients confidence, but it also demonstrates your professionalism by using a reliable, well-known legal company (Legal Zoom).

3. SignWell accounting contract

The accounting contract template from SignWell can be exactly what you need if you want a simplified, digital-first strategy. This template was created with user-friendliness in mind, making it ideal for accounting firms that wish to maintain a contemporary and effective look.

Thanks to its simple form and sections, you can easily customize the agreement to represent the special services and client relationships offered by your company.

SignWell’s template covers all the essentials, including:

- Scope of work: Clearly defines the range of accounting services your firm offers.

- Payment terms: Outlines billing details, deadlines, and conditions for a truthful financial process.

- Confidentiality clauses: Gives clients confidence knowing that sensitive information remains secure.

- Digital integration: Supports seamless e-signatures for a faster, more efficient contracting experience. Check out Copilot’s Contracts App for this.

All things considered, SignWell's accounting contract is a wise, easy-to-use option that can help your business run more efficiently.

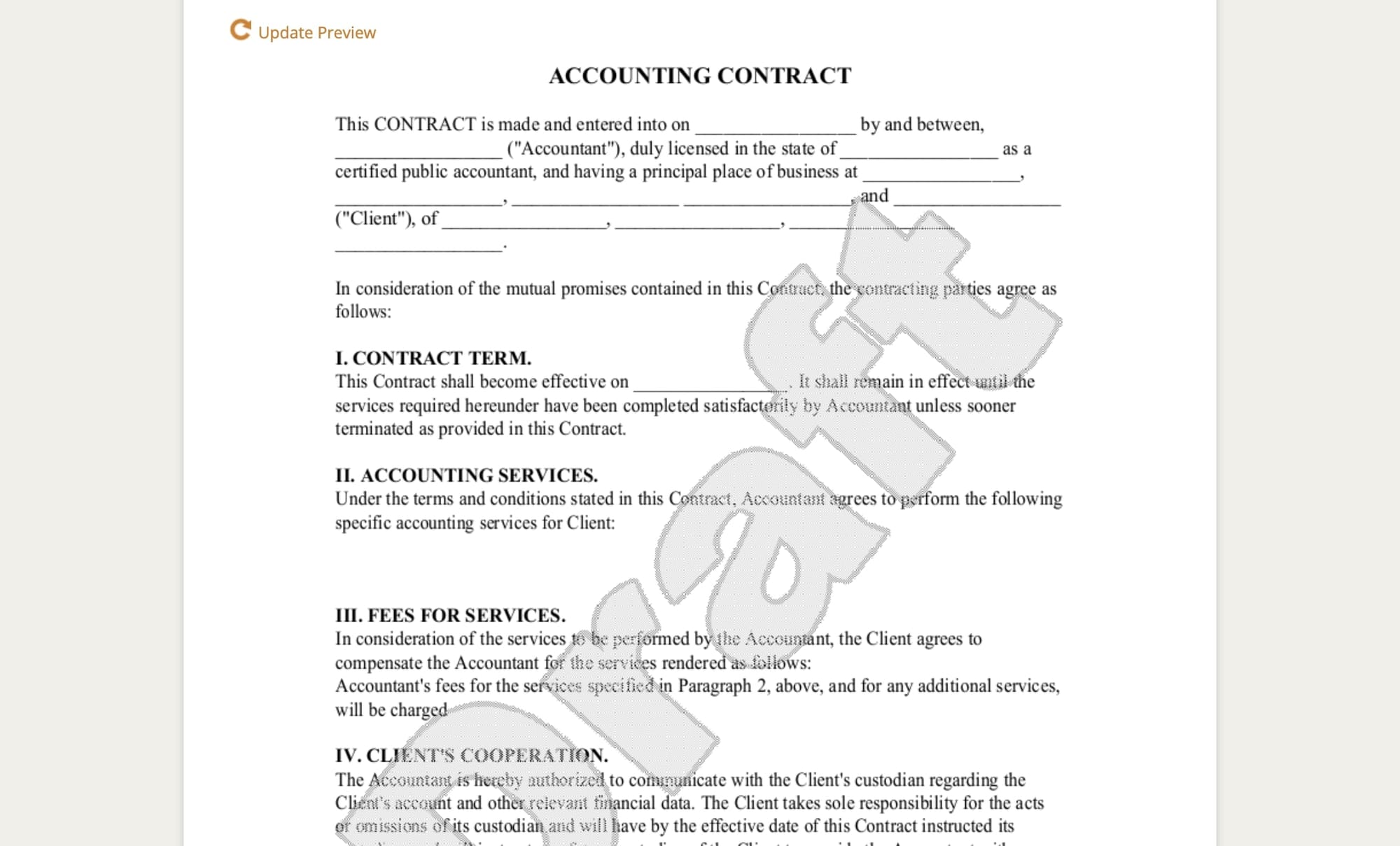

4. Signaturely accounting contract

If you’re looking for something that can easily be downloaded as a Doc or PDF, you have to check out Signaturely’s accounting template.

It's really easy to modify and customize to meet your unique services. The template covers everything, including:

- Service specifics: It describes in detail the variety of accounting services you provide.

- Payment & billing: The template clearly and simply spells down the terms of payment and the billing schedules.

- Confidentiality assurances: It contains important provisions to protect the private data of your clients.

- Digital tools: Contract signing and management are made quick and easy with integrated e-signature capabilities.

I like how this template allows you to keep that personal touch with your clients while making it easy for you. It's a great choice if you want to maintain efficiency without making your contract look like it was put together with duct tape.

5. Rocket Lawyer accounting contract

Last but not least, we have Rocket Lawyer’s accounting contract. This template is great if you’re looking for a blend of legal thoroughness and user-friendly customization. It goes over all of the points we talked about earlier in this article and gives you a strong legal foundation for your services.

Here’s what I like about this contract:

- Service descriptions: It clearly defines the range of accounting services you provide, setting clear expectations for both you and your clients.

- Transparent payment terms: The template outlines billing cycles, fee structures, and payment deadlines.

- Confidentiality clause: It includes essential clauses to protect your client's sensitive financial information.

- Flexible termination & amendment guidelines: Provides clear instructions on how contracts can be updated or terminated as your business evolves.

- Legal standards: The template is made by a legal company, so you can trust it’s been vetted and carefully looked at.

Overall, this template is great if you want to make sure your contract is legally sound and vetted by a legal company. Just like Legal Zoom, this template is trusted and secure.

Run a modern accounting firm

Finding the right accounting contract template to keep your legal ducks in a row is just the first step to running a successful client business.

As we've explored, whether you lean towards Nitro's sleek design, Legal Zoom’s brand name, SignWell’s simplicity, Signaturely’s adaptable format, or Rocket Lawyer’s legal status, each template offers a unique way to secure your services and clarify client expectations.

The next step is getting your contract signed, onboarding your clients, giving them exceptional service, and getting paid. That’s where Copilot comes into play.

Copilot helps you run every aspect of your accounting practice. From contract management, automated onboarding, flexible billing and invoicing, and client communications — you can do it all.

Try it out for yourself:

If you’re ready to enhance the client experience for your accounting practice, be sure to play around with the full demo portal for accountants!

Share this post

Sign up for our newsletter

Subscribe to our newsletter to receive emails about important announcements, product updates, and guides relevant to your industry.